Hot Property Estates Q&A: 2022 Southern California Real Estate Predictions

Like everything changed by the pandemic, real estate in Southern California has undergone significant evolution over the last three years. Now, with the economy emerging from lockdown and uncertainty, there is no hotter property market in the country than the Los Angeles region, for both buyers and sellers.

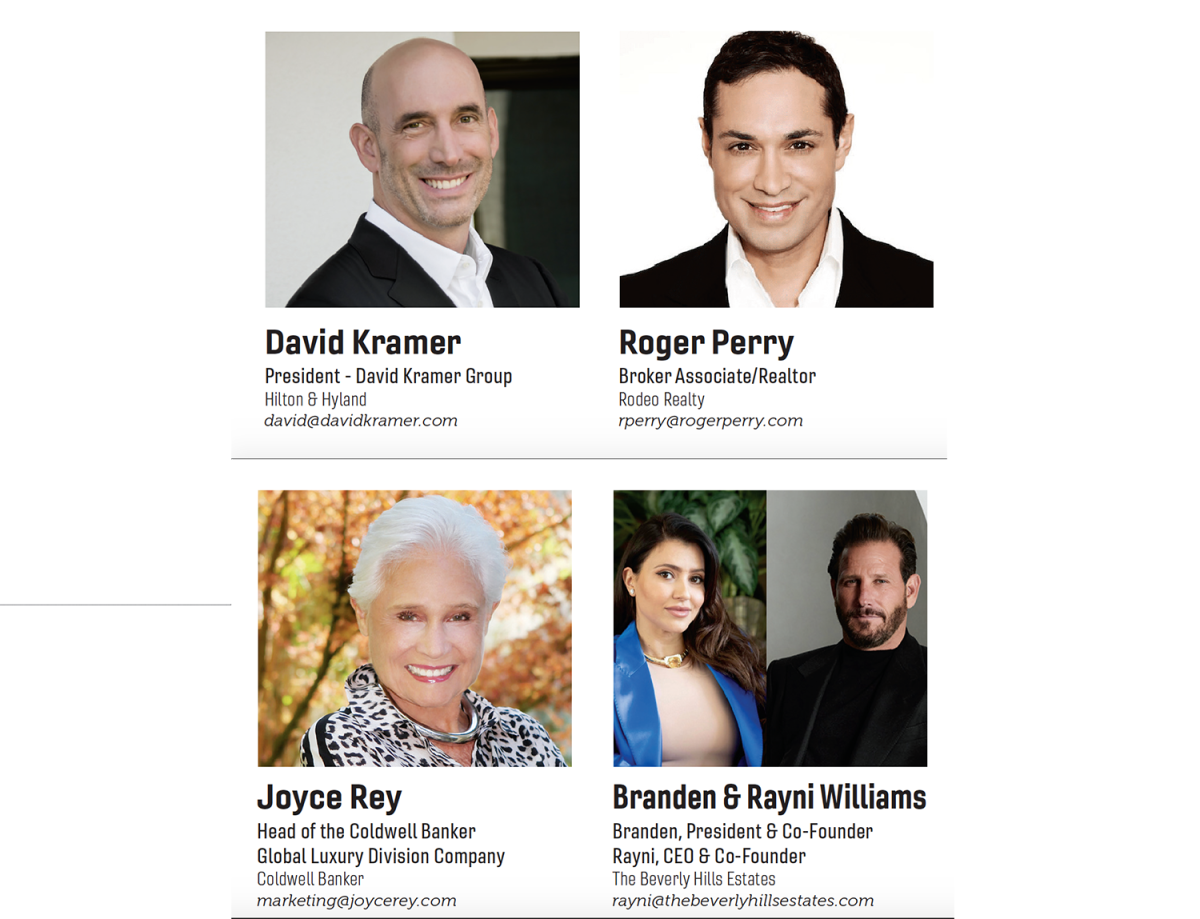

While significant flux is still occurring in both interest rates and scarcity, more buyers than ever are flooding the market, purchasing both primary and secondary properties where they live, work and enjoy. We turned to five Southern California real estate experts to get their insights on the current market and their predictions for the rest of 2022.

Q What is your real estate forecast for 2022? Do you believe that inflation in other parts of the economy will affect the market?

David Kramer, President - David Kramer Group, Hilton & Hyland: There’s no doubt that we’re currently in a seller’s market with record prices and low inventory. However, with mortgage rates at all-time lows, we’re seeing major demand from buyers as well to get into the market.

Branden & Rayni Williams (Branden, President & Co-Founder, Rayni, CEO & Co-Founder), The Beverly Hills Estates: We believe that inflation, along with world events, will play a part in the market. However, there is no better place to live than in Southern California, and for that reason we are still seeing buyers migrate to Los Angeles from all over the world. It is a safe haven, although not a tax haven, with a wonderful quality of life offering mountains, ocean, and desert, all within driving distance. And, of course, Los Angeles is the mecca of every industry.

Joyce Rey, Head of the Coldwell Banker Global Luxury Division Company, Coldwell Banker: Based on first quarter sales, we are seeing historic sales volume for luxury properties in the Southern California markets, with high buyer demand creating huge pressure on pricing. Inflation has most definitely impacted the desire to invest in all types of real estate. Also, with the likelihood of rising interest rates, there is an immediate rush to buy. It is the ideal seller’s market and a great time to list your home for sale!

Roger Perry, Broker Associate/Realtor, Rodeo Realty: The demand may slow a bit and the inventory may increase a bit allowing the market to get back to a healthier level. The low interest rates have allowed prices to increase due to demand and have put the housing market in inflation territory.

Q: What are your top three predictions for Southern California real estate in the next year?

BRANDEN & RAYNI WILLIAMS: We predict that Los Angeles will always be one of the strongest cities in the world. Also, due to inflation, we foresee tangible assets will be on the rise even more so. We are looking at rising interest rates and when that happens prices tend to lower. With a lower purchase price, you are also lowering your tax basis, so therefore a higher interest rate is always more desirable. For all these reasons, we feel that it is a very sustainable real estate market and it will remain strong.

KRAMER: I expect to see the demand in gated communities continue to grow, particularly post-COVID. I think Los Angeles will continue to be a top destination for the ultra-high-net-worth clientele looking for the best trophy properties and lifestyle.

REY: Continuing inflation, increasing interest rates, and sustained high buyer demand.

“One of the advantages of second home ownership is the ability to lease for short-term rentals, offsetting some of the operating costs.”

— -David Kramer

PERRY: 1. A leveling of the housing market inflation curve. 2. More inventory for buyers to choose from. 3. Buyers who left the scene will return now that there is a chance for them to compete.

Q: As loan rates fluctuate as we emerge from the pandemic, how do you believe this will change the way people approach real estate?

REY: It depends on the interest rate. At some point it begins to discourage buyers. Right now, the threat of increased rates is prompting them to move quickly. The affordability factor is a definite concern.

PERRY: Rates are still low. The initial increase may temporarily intimidate some buyers, but it will not affect them heavily in the long term unless they keep increasing sharply. There is no mass answer for market activity - performance is area-based. Certain areas will still receive multiple offers for one reason or another, regardless of the increased rates. In other areas, you will see price reductions to accommodate the new cost of money.

BRANDEN & RAYNI WILLIAMS: We feel strongly that a rising interest rate indicates a lower purchase price can be had, and that can be very favorable. We also must keep in mind that we have had historically low/ negative interest rates for quite some time, and we have all become very accustomed to that. However, a 5 to 7% interest rate has always been customary, so it is just a matter of time before we reacclimate.

“Because of the pandemic and the prevalence of remote work, the secondary home location has become one’s primary residence and as a result appreciated tremendously.”

— -Joyce Rey

KRAMER: In the sub $10-million market, I anticipate the market to temper and become a bit less frenetic, although the demand will remain strong over the next 12 months. Increasing interest rates will have a small cooling effect on the housing market, but I still don’t see this being a major factor, unless rates climb significantly. The impact of the pandemic has changed the demand for residential real estate with buyers now considering their home to be their sanctuary.

Q: More and more people are considering a second home. For L.A. residents, what are the top vacation/second home locations, and what benefits are buyers seeing?

PERRY: The pandemic has encouraged many second home purchases. Many people can work remotely, and companies are flexible with locations. Many want a change of scenery for themself and for their families. I see a tremendous increase in desert cities (Palm Springs/Palm Desert); beach cities (Malibu, Dana Point, Santa Barbara); and woodsy getaways (Big Bear, Arrowhead, Lake Tahoe). Demand has sharply increased - in some cases, we see increased acquisition numbers of up to 400% from what they were only five years ago.

“There is no better place to live than in Southern California, and for that reason we are still seeing buyers migrate to Los Angeles from all over the world.”

— -Branden and Rayni Williams

KRAMER: Along with the shift of people wanting larger homes and more space so they can work and entertain, they are also looking for vacation property. I know people are looking across the country for a second home, but the majority seek a California beach or desert location. More reasonably priced beach communities such as Ventura, San Clemente and Carlsbad have grown significantly in popularity. The same is happening in the desert communities of Palm Springs, Joshua Tree and the surrounding areas. One of the advantages of second home ownership is the ability to lease for short-term rentals, offsetting some of the operating costs.

REY: Montecito/Santa Barbara/Carpinteria are the most sought-after locations. Additionally, Palm Springs, Newport/Laguna Beach, as well as La Jolla are frequent choices. In the past, second homes have not appreciated as significantly and have merely provided a lifestyle alternative. Because of the pandemic and the prevalence of remote work, the secondary home location has become one’s primary residence and as a result appreciated tremendously.

Rates are still low. The initial increase may temporarily intimidate some buyers, but it will not affect them heavily in the long term unless they keep increasing sharply.”

— -Roger Perry

BRANDEN & RAYNI WILLIAMS: Angelenos have always considered local favorites such as Malibu, Palm Springs, and San Diego great vacation and second home locations. Now many people are venturing beyond the Golden State and purchasing vacation homes in some of their favorite places to visit such as Hawaii, Florida, and other exotic places.